First Half 2014 Market Review

The first half of 2014 can be characterized by financial stability and rising equity/bond markets. Although we did not anticipate strong bond markets in our yearly preview, we were sure that equities would out-perform other assets especially European equities. As of June, this is exactly what happened. Bond markets performed well because of central banks’ involvement in buying bonds which dragged down yields. A view of fundamental data shows that this bull market in bonds cannot last forever. It will certainly end, as the free capital market becomes more and more a “guided” market, lead by the Federal Reserve Bank, European Central Bank and Bank of Japan, among others. This article will explain the fundamental data trend further on. The article will focus on the US economy, US and European bonds and in particular Russia. Interesting developments happened in Russia, including coordination with China and other countries which could be considered an attack on the hegemony of the US Dollar. The tendency of emerging markets to diversify trade currencies was observable already for a while but the speed that we see now is very interesting and has major implications.

The focus of this report will be on financial markets and the state of the economy, but political risk should also be considered as it can be a driving force of financial markets. For our clients we are continuing to watch the situation in Ukraine carefully. Studying the situation and listening to corporate executives, there is a common thread to their opinions that Europe should oppose the continued presence of US interference in a European matter. Many do not talk about this openly, as they fear consequences for their businesses, but in private it is a different matter. We also see that Ukrainian authorities have struggled to exert control in their country. The Russian government took a strategic stance in the current conflict by tightening relations with China, and to a lesser extent India and South America. It is highly likely that the standoff in Eastern Ukraine will be resolved by the end of the year. This will allow Russia – Europe relations to improve without interference of the United States. We also think it is a good moment to increase exposure to Russian equities, as they are under-valued.

State of the US economy and financial markets

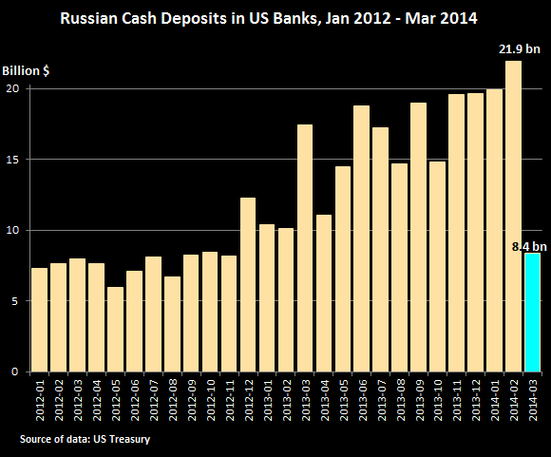

The US economy is showing some serious signs of trouble. The Federal Reserve is trying to get out of its quantitative easing program, designed to buy US bonds and Mortgage Backed Securities. From US$85 billion per month in the beginning, we are now (June 2014) down to monthly asset purchases of US$35 billion. It seems the FED will exit this program by the end of the year but ultra-low interest rates will remain. Whether this was a success, only time will tell. However, what we can say is that US banks had the chance to reorganize their balance sheets and emerge “healthier”, compared to their European counterparts. US banks will also feel sanctions initiated by the EU and US against Russia and Russian officials. In March 2014 alone, Russians withdrew more than 60% of their deposits from US banks (US$21.9b in February to US$8.4b in March).

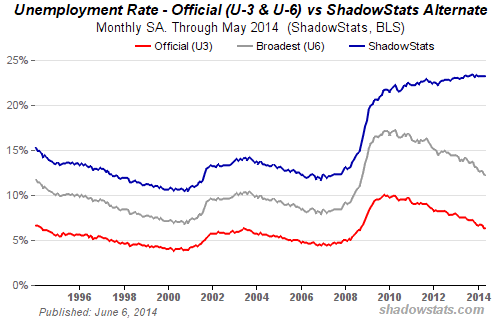

US equity markets reflect that the economy should be in a very good state but this is not all so true. Reviewing how many people rely on food stamps under the Supplemental Nutrition Assistance Program: In 2008, 28.223 million participated. In 2013, 47.636 million received assistance – an increase of almost 70%. For comparison purposes, from 1985 (19.899 million) to 2000 (17.194 million) this figure decreased in real and absolute terms. An interpretation of these latest figures could be that many ordinary US citizens do not feel the recovery which has had much more benefit to investors and Wall Street banks. Other official figures seem to conflict with this http://www.shorelinebrokers.com/wp-admin/post.php?post=432&action=edit#assessment at first glance. The unemployment rate dropped since peaking at the end of 2009 from 10% to 6.3% in May 2014. Pure figures show a nice recovery, but this number also included many people who dropped out of labor force as they gave up looking for a job. The Civil Labor Force Participation Rate went down by about 3% since the crisis of 2008/2009. Meaning that the “real” unemployment rate did not change. Other sources like John Williams’s Shadow Government Statistics draw an even more dramatic picture of an unemployment rate above 20%.

Now ask yourself, would you lend your money to a county that has the highest debt in the world, may never be able to repay its debt and could have enormous socio-economic troubles? Would you like to rely solely on the public pension of a country that might have to declare bankruptcy at some point? Pension shortfalls and spiraling debt in major cities like Detroit and Chicago could be a preview of a national crisis. We recommend private retirement planning outside of any public pensions as the only way to build up a reliable source of wealth for retirement. Private retirement planning relies on global investments to generate returns, instead of public pensions which are unsecured and underfunded debts open to possible default in the future.

US and European Bond markets

This analysis will focus on US and European bond markets but similar situations apply to Japan and Great Britain. Bond markets globally are manipulated by government interventions in the form of quantitative easing, bond-buying programs, central bank guarantees, ultra-low interest rates and other factors. Looking at the graph below, one can see the development of European bond markets. With the introduction of the Euro, interest rates in peripheral Europe, namely Greece, Italy, Spain and Portugal, but also Ireland, decreased to levels never seen before. This inferred creditworthiness of these countries on the same level as Germany. In the aftermath of the financial crisis 2008/2009 and the following Euro crisis, credit spreads between German and Southern European countries’ bonds increased dramatically. To decrease tensions, Mario Draghi pledged in 2012 to do whatever it takes to save the Euro. Since then yields on peripheral Eurozone bonds decreased to historically low levels. On the 18th of June, Spanish 10 year government bonds yielded 2.7% and Italian government bonds 2.86%, compared to 2.59% on 10 year US government bonds. Whether the spread between Spanish/Italian and US government bonds is justified is arguable. Shoreline thinks that yields on government bonds do not reflect the real credit risks. Many European countries have unsustainably low yields only due to massive government intervention.

Russia and Policies of Russian Officials

Lately some very important measures by the Russian government were taken to combat Western sanctions, mainly pushed by the United States. It seems that these sanctions are now backfiring because Russian state-owned companies are increasing their efforts to seek other options beyond US dollar denominated payment systems. A major deal was made between China and Russia to trade oil and gas only in local currencies. Gazprom announced the switch to local currencies and Euros for its trades. Most of Gazprom’s trading partners already agreed already to do so. Although sanctions were laid on Russia, the economy has not done as badly as expected. The Ruble strengthened over the last three month against a basket of foreign currencies and big banks like Bank of America/JP Morgan are recommending buying Russian equities while they are still cheap. These developments have significant implications on our outlook for the second half of 2014.

Looking Ahead! Where to Invest until the End of the Year?

Equities

Regarding equities, we still hold the opinion that they provide the best return on risk. We still would recommend holding a portfolio more weighted to European equities and slowly switch from US equities to emerging markets equities (which are starting to look very cheap). We like Russian companies like Lukoil, MTS and PhosAgro. We have also select good investment opportunities in China, India and Brazil. We mainly selected equities operating in a stable business environment, having a sound business development plan, strong management and a clean balance sheet. We would not abandon the US equities market entirely, but we would like to reduce our exposure to certain US industries. We still like US consumer goods, oil & gas, technology and REITs.

The major driving force that we highlighted in our 2014 preview report, the great rotation between from bonds to equities, has still not finished. Bond markets performed quite well over the first six month of 2014. However, yields on bonds are low and investors, institutional and individual, will have to seek return in equity markets.

Fixed Income

For investors seeking stable income in fixed income products we would not recommend to buy US or European government bonds. Some corporate bonds yield a nice return of 6-7%, like certain Gazprom and Lukoil bonds, but also some emerging markets’ sovereign bonds offer great returns. An ETF on corporate or emerging market sovereign bonds can be a good investment too.

Currencies

Events surrounding the crisis in Ukraine make us back off from our position that the US Dollar will strengthen significantly over other major currencies. Under current developments, we think it most likely to see a depreciation of the dollar due to its possible reduced usage in international trade. Overall, we are neutral on any major currency and recommend holding assets in various currencies to diversify risk.

Gold

Developments in Ukraine and the push of Russia out of the US Dollar system gives us some new perspective on gold. The price of gold could increase from a reduced reliance of the US Dollar in many trade deals. In the long run, it is highly likely that the world will find a way to establish another global trading currency, but in the meantime gold could be used for trade deals. Rumors exist about China planning to “internationalize” its currency the Renminbi by backing it with gold. The Russian central bank is buying gold, as have some other central banks. Just as Russia has used energy supplies as a political tool, the US’s political tool of denying access to US Dollars makes it likely that other countries will also look for ways to follow this. This could result in renewed interest in gold. Investors agreeing with this view could buy physical gold or gold mining equities. Another possibility is to buy physically backed gold ETFs which are easier to administer than actually holding real gold in bank vaults. Gold mining companies offer nice investment opportunities, especially Barrick Gold, as these companies’ share prices will soar when gold prices increase.

Although we see good chances for gold prices to increase based on political risk, there are still risks and we will watch developments further. We would recommend buying gold and gold producers on a speculative basis.

Investment Review

Here is a short review of our main investment recommendation over the past 6 months.

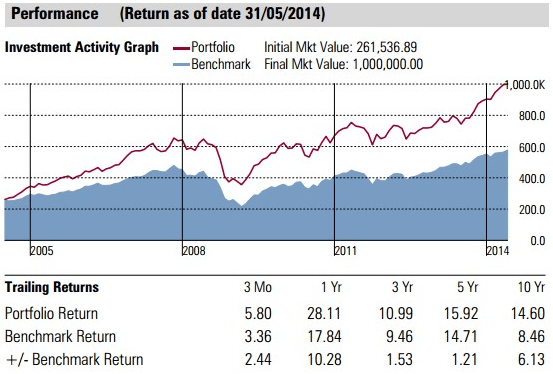

At the beginning of the year, we set up a model portfolio that performed well over the course of the last 6 month, returning around 11% profit, including dividends. The historic return of the portfolio is shown in the performance graph below. An investor who invested US$261,536.89 10 years ago would have US$1,000,000 today. This would mean an average return of 14.6% per annum. A good choice of profitable and well-managed companies with some good market timing, can result in an even better return.

However, every investor should be aware that equity markets are risky and not a one way bet. In the graph, one can see that our model portfolio also suffered a huge loss in 2008/2009 but it recovered from its losses much faster than the broad FTSE Global All Cap Total Return index.

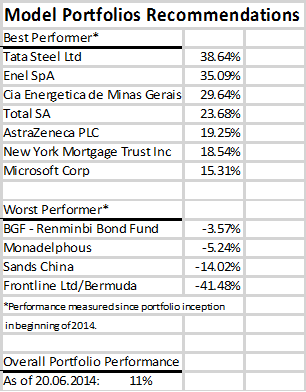

Next, is a performance overview of our recommendations. These returns of are pure capital gains which exclude dividends. So for example, we ignore that Monadelphous paid a dividend of around 7.5%. Taking this into consideration the return on Monadelphous would not look as bad as shown in the table shows.

The best performing equity in our model portfolio is Tata Steel, an Indian steel producer/construction firm. Second is Enel SpA an Italian utilities company and third Cia Energetica de Minas Gerais, a Brazilian utilities company. The list is not comprehensive, many of the other equities in the portfolio yielded around 10%, a few lost value such as Frontline Ltd around 42%. We only had a very small position in this company, as we know about its risky nature (operating in the sea transport of oil).

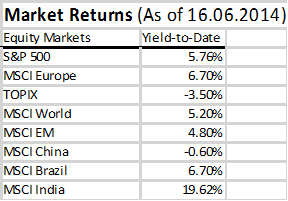

Market returns are shown below for comparison. The worst performing stock market in the list is the Japanese TOPIX falling 3.5%. Worldwide markets generally gained in value with the MSCI World index advancing by 5.2%. In our outlook for 2014 we mentioned India and Brazil as prospectus markets where we picked Tata Steel and Cia Energetica de Minas Gerais, respectively. Our assessment that these companies would be able to outperform corresponding markets worked well. Tata Steel generating a return of 38.64% compared to the 19.62% return on MSCI India. Cia Energetica de Minas Gerais’s equity price increased by 29.64% compared to the 6.7% increase of the MSCI Brazil index.

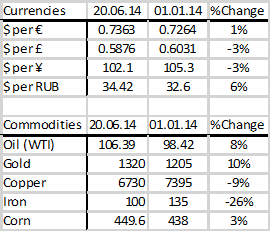

Reviewing currencies and commodities, most major currency pairs did not move significantly either way, but some emerging market currencies depreciated in US Dollar terms especially the Russian ruble during the start of the year. However, the ruble recovered some of its losses and over the course the year and was only down -6% in value against the US Dollar. Commodities show a mixed picture. Some assets dropped significantly in value over the past 6-month. Iron ore decreased -26%, followed by copper with -9%. This is a clear indication that the world economy is still suffering, especially the demand in China for these economic sensitive commodities decreased substantially. On the other hand, oil and gold price rose by 8% and 10% respectively.

Shoreline is constantly monitoring global financial markets to find great investment opportunities. For any questions regarding this article please contact Stephan Genz.

stephan.genz @ shorelinebrokers . com

www.shorelinebrokers.com

DISCLAIMER: Comments/charts do not necessarily imply their suitability for individual portfolios or situations in respect of which further advice should be sought. Shoreline is not responsible for the content of external internet sites.This information used in this newsletter has been prepared from a wide variety of sources that Shoreline, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about the investments and we strongly suggest you seek advice before acting upon any recommendation. The opinions expressed in this report are those held by the authors at the time of going to print. The views expressed herein are not to be taken as advice or recommendation to sell or buy shares. This material should not be relied on as including sufficient information to support an investment decision. Any forecasts or opinions expressed are Shoreline’s own at the date of this document and may be subject to change.

WARNING: Investing involves risk. The information provided by Shoreline in this newsletter is for general information only, which means it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it, seeking advice from a financial adviser or stockbroker if necessary.