Retirement planning – It’s not rocket science

Retirement Planning and Implications

After writing a couple of articles on the current state of the economy and financial markets, we wanted to put our focus on retirement planning. The aim of this article is to show interested individuals the benefits of long-term retirement planning.

Many people want to know how to create wealth and to make a fortune. In the following, we provide an example of what can be achieved by simply investing in a broad stock market index, in this case the S&P500, which is a widely used US stock market index. Our analysis is based on a time horizon from the beginning of 1990 until May 2014. The chart of the S&P500 below shows a nice advancement from well below 400 points in 1990, up to above 1900 points in 2014. Based on this timeframe, the index generated an average return of 7.3% per annum.  As shown in the chart, we had two major stock market corrections which lasted about 2 years each. During these crises, the market lost around 40% of its peak value. Although these drops are huge, the overall performance of the S&P500 is still 7.3% p.a. This is without the additional performance attainable by exiting and entering the broad market at opportune times, and without any focus on specific industries or companies.

As shown in the chart, we had two major stock market corrections which lasted about 2 years each. During these crises, the market lost around 40% of its peak value. Although these drops are huge, the overall performance of the S&P500 is still 7.3% p.a. This is without the additional performance attainable by exiting and entering the broad market at opportune times, and without any focus on specific industries or companies.

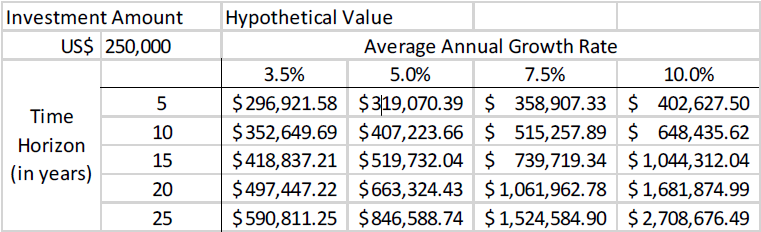

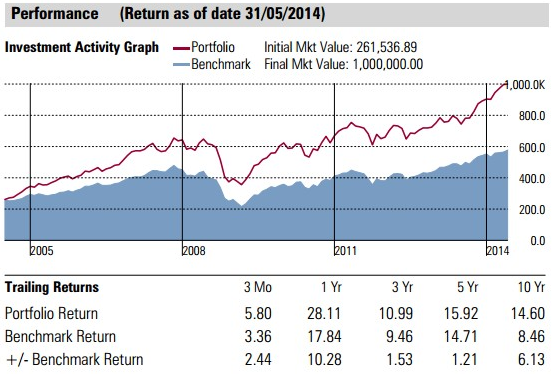

The following table shows what can be achieved with different returns over different time spans. Starting with a hypothetical investment of US$250,000 and a return of 7.5% per annum, the growth over 20 years would result in about US$1,000,000. This could be achieved by passively investing in the broad market index. Choosing the right companies with above average growth and profitability can enhance this performance drastically. Assuming 10% average return per year, it only takes 15 years for an investment of US$250,000 to grow into a wealth of US$1,000,000. Assuming the growth rates can be achieved, higher investment amounts would also lead to higher final values, e.g. US$500,000 could become US$2,000,000 after 20 years assuming 7.5% growth.  At the beginning of the year, Shoreline put a model portfolio together consisting 85% of handpicked stocks and 15% of fixed income products. Handpicked stocks include ENEL S.p.A., AstraZeneca and Total SA, among others. The return to date is around 10% and a historic performance over the past 10 years can be seen below. This graph shows nicely that a sum of US$261,536.89 invested only 10 years ago would have grown to US$1,000,000 today. This is an average return of 14.6% per annum.

At the beginning of the year, Shoreline put a model portfolio together consisting 85% of handpicked stocks and 15% of fixed income products. Handpicked stocks include ENEL S.p.A., AstraZeneca and Total SA, among others. The return to date is around 10% and a historic performance over the past 10 years can be seen below. This graph shows nicely that a sum of US$261,536.89 invested only 10 years ago would have grown to US$1,000,000 today. This is an average return of 14.6% per annum.  This clearly shows that investing in equities can be very profitable and should be a core part of everybody’s retirement planning.

This clearly shows that investing in equities can be very profitable and should be a core part of everybody’s retirement planning.

If an investor has 10 years to retirement and wants to take on some risk to live a decent live after retirement, what options available to generate sufficient wealth before reaching retirement?

Some people would consider real estate as suitable investment to generate income for retirement. At first this might appear to be sensible, however there are serious risks which some people choose to ignore. Real estate is expensive and usually involves borrowing money, so the investor has a risk of losing more money than is actually invested. The investor must also consider the effects of mortgage payments, insurance, repairs, property taxes, and problems with tenants on any property which is considered an investment. Property is an asset class like any other, so it also involves ups, downs, bubbles, and crashes. Unfortunately, the illiquidity of property makes it difficult to sell quickly when the market does eventually turn.

Another option, and often regarded as very safe, is to deposit savings in a bank account. Unfortunately, the interest on savings account deposits is near zero and often does not even keep up with inflation rates. This means an investor will always lose money in real terms, thus the investor will have to save an incredibly large amount of money to generate any real wealth.

Government bonds are also seen as a way to save for retirement because they generate more income than a regular bank account. As central bank balances are growing and Western governments’ debt ballooning, we doubt that governments will ever be able to pay back their debt. Considering this and the ultra-low yields on government bonds our advice would be not to invest a large part of retirement wealth in government bonds.

This leaves us with the best possible way to diversify and build wealth: corporate equities. Our analysis shows that although crises have happened (and will happen again), equities are the best way to build up wealth over the long term.

Implications for Retirement

Let us imagine a client that has a 10-year time horizon until retirement and invests the US$250,000 which has accumulated from a regular savings plan. Using Shoreline’s model portfolio this initially invested capital could grow into US$1,000,000 of wealth. Assuming a dividend yield of 4% per annum on the portfolio, the client would have US$40,000 without touching the $1,000,000 principal cash. This means the investor would have US$3,333 per month to cover expenses purely from dividends, while the $1,000,000 remains untouched and could generate this monthly income forever. The principal amount ($1,000,000) could be left for other family members and beneficiaries to enjoy, and possibly for their own retirement capital.

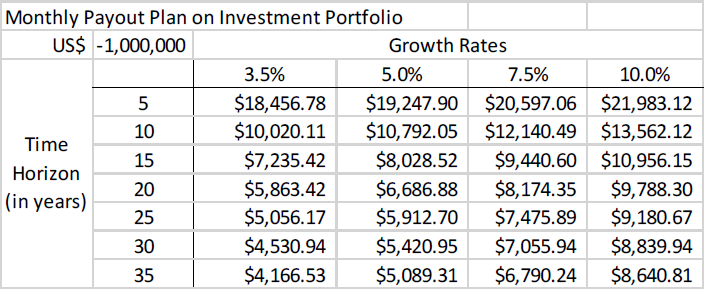

If the client considers withdrawing a regular income from the principal amount and not just the income, this would increase the monthly amounts significantly. However, the client will need to be careful not to run-down their entire principal amount while still alive. The table below shows different scenarios based on a principal amount of US$1,000,000 that will be reduced to nothing over a set amount of time. Assuming 3.5% growth on a principal amount of $1,000,000 and a time horizon of 25 years, the client would be able to increase the monthly income levels to $5,056. A larger amount of saved capital would lead to more monthly income and/or a longer time period before the capital is gone. Assuming the client would have saved double the amount, payouts can be expected to double as well.  To discuss your financial planning requirements, please contact Shoreline.

To discuss your financial planning requirements, please contact Shoreline.

Author: Stephan Genz

DISCLAIMER: Comments/charts do not necessarily imply their suitability for individual portfolios or situations in respect of which further advice should be sought. Shoreline is not responsible for the content of external internet sites. This information used in this newsletter has been prepared from a wide variety of sources that Shoreline, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about the investments and we strongly suggest you seek advice before acting upon any recommendation. The opinions expressed in this report are those held by the authors at the time of going to print. The views expressed herein are not to be taken as advice or recommendation to sell or buy shares. This material should not be relied on as including sufficient information to support an investment decision. Any forecasts or opinions expressed are Shoreline’s own at the date of this document and may be subject to change.

WARNING: Investing involves risk. The information provided by Shoreline in this newsletter is for general information only, which means it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it, seeking advice from a financial adviser or stockbroker if necessary.