How inflation affects your investments

Inflation is coming, so in this article we assess how inflation affects your investments. Global central banks’ perennial money printing and government’s budget deficits create inflation. Not too long ago a lot of media covered this topic, but not so much recently. This is not because the problem went away, but rather the opposite. Rising inflation is now accepted and practically does not cause any objections.

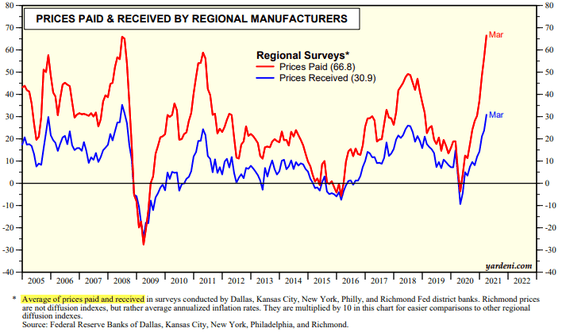

Most experts agree that the main driver of inflation will be the cost-push inflation. Commodities are the main cause because, unlike money, they cannot be printed. Commodities will gradually penetrate all production chains. The diagram below clearly shows that these processes accelerate.

The diagram shows US prices of manufacturers. The red curve is what they pay for purchase of raw materials. Blue – for the sale of their products. We reasonably assume that such diagram is appropriate for any country. As you can see the purchase cost rises faster than the sale price which likely will need to correct.

History repeating?

The inflation expectation that we warned about during the last two years is slowly turning…into actual inflation. Let’s look at a similar situation from the past, not too long ago, and focus on the 1970s.

Back in the 1970s due to the Arab-Israeli conflict in the Middle East the Arab countries imposed an embargo (sanctions nowadays) on the supply of oil to Western countries. The oil price went up several times at once. Oil forms the base of most production chains and caused high inflation for several years.

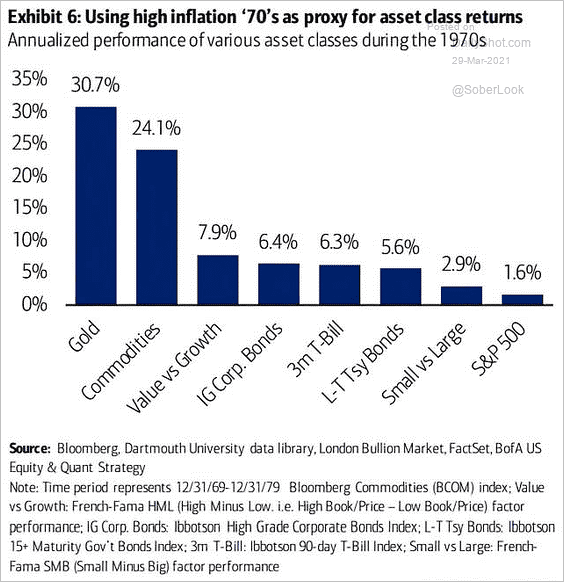

Although looking back to past performance is easy let’s do it in order to see how inflation affects investments for an investor in the 1970s. Which asset classes should he choose in order to benefit from inflation, or at least maintain its value. The following picture will be useful:

What was the performance of different asset types during these years?

First, gold. Investors are skeptical about this asset class as gold and gold mining companies headed the list of the worst annual return results investments during the 2011-2018 period.

The second place – commodities (raw materials). They were the initial cause of inflation in the 1970s.

Next, with approximately the same yield, are various assets of the fixed-income category.

But the most unexpected asset class is the S&P-500 index. The average growth is just + 1.6%.

History does not repeat itself exactly and circumstances are different, but we can make certain general conclusions regarding investments. We believe that in an inflationary environment government bond yields will, rise (prices go down), thereby compromising the present bondholders.

In today’s low interest rate environment we believe that the S&P500 index, in contrast to the 1970s, will do well. The recent announcement of the next tranche of incentives for US infrastructure projects confirm our expectations.

What about gold and the commodity market in general? As we have regularly said we consider it a mandatory part of our clients’ portfolios. We have increased holdings to these sectors and they have shown significant performance in 2020. The poor performance of this sector not too long ago combined with the expectation of higher future inflation should lead to excellent results.

Inflation affects your investments but how, in a good or a bad way, depends on your portfolio. You can invest in individual stocks or via collective investments (index, ETFs) and this choice depends on the risk preferences and experience of each individual investor. If you are interested in this topic and would like advice about this selection – contact us. We will be happy to help!