Difference between Mutual Funds & ETFs – What is right for you?

Invest in Mutual Funds or ETFs – some background information:

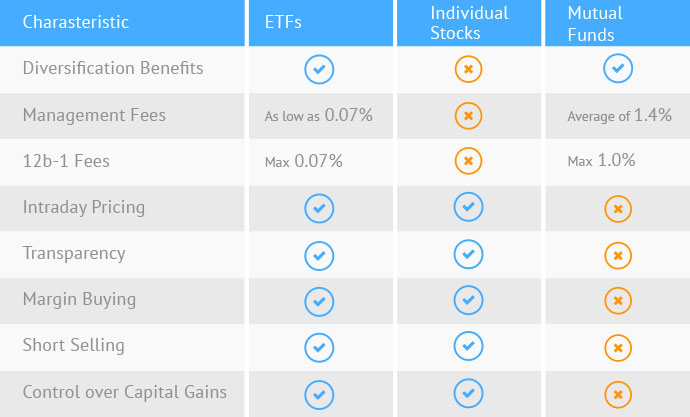

Should I invest using mutual funds, the weapon of choice to invest for several decades, or better use Exchange Traded Funds, known as ETFs ? ETFs are relatively new, but now exist for over a decade. In this article we look at some differences of which you should be aware. For a detailed explanation of the types of mutual funds and ETFs click here.

Both Mutual funds and exchanged traded funds (ETFs) are simple ways to invest into a group of assets. They both can focus on a specific country, industry, asset type, investment strategy, or combination of these. You can think of it as of owning a small part of an investment holding company. You acquire ownership in the collective assets held by the fund or ETF. The main benefit of both mutual funds and ETFs is a lower costs for holding a diversified mix of assets compared to buying individual shares yourself.

Running Costs:

All mutual funds have expenses which include possible commissions & redemption fees and operational expenses. Operational fees include managements costs and miscellaneous fees such as advertising or distribution expenses. Mutual funds justify their management fees by attempting to outperform a certain benchmark using active trading strategies. If a fund can outperform its benchmark by at least the management fee, then an investor can justify paying the higher fees.

An ETF, like a mutual fund, is a pool or basket of investments. However, ETFs usually have much lower expenses than a similar mutual fund because there are no commissions to pay. The very low operating expenses are due to a lack of active management with ETFs. Most ETFs invest passively in a group of assets with predetermined conditions and a computer trades instead of a human.

In both cases, additional transaction fees usually apply, but will largely depend on the size of your account, the size of the purchase and the pricing schedule associated with each brokerage firm.

What about trading?

ETFs offer greater flexibility than mutual funds when it comes to trading. Purchases and sales take place directly between investors and the fund. The price of the fund is not determined until the end of a business day, when net asset value (NAV) is determined. An ETF, by comparison, is created or redeemed in large lots by institutional investors and the shares trade throughout the day between investors like an equity.

What about ETF Liquidity?

The number of shares traded per day is a measurement of trade volume, expressed as liquidity. Broad-based index ETFs with heavily traded assets have very high liquidity. ETF liquidity could dry up in severe market conditions for narrow ETF categories, or highly-specific products with low trading volume. An investor is to such avoid ETFs. Avoid small mutual funds with non-liquid investment objects such as property.

Are ETFs safe long term?

A consideration before investing in ETFs is the potential that an ETF provider becomes insolvent. As so many ETFs exist in the marketplace, the financial health and longevity of the sponsor companies plays a great role. Investors should only invest in ETFs of well-established companies to avoid unpleasant surprises. The same applies to mutual funds.

The Bottom Line

Investors benefit from increased choices and better product variations when there is competition among providers. It’s important to understand the differences between ETFs and mutual funds (even those which invest into the same assets), and how those differences may impact your investment process. An experienced investor, who knows which strategy he pursues, is effectively his own manager. Therefore, he can afford not to use the manager from the mutual fund and save money. Mutual funds are perfect for people who have no time to follow the market or no knowledge to set-up their own strategy.